CPU multiplier Wikipedia

If

Φ

and

Ψ

are Gabor (or wavelet) systems,

m

is

NBB, and

Mm,Φ,Ψ

is unconditionally convergent and invertible, then

P˜3

holds. If you prioritize US policy, being a permanent resident of a state and living in DC temporarily makes sense. But living permanently in DC forecloses an entire path through which you could have impact, i.e. getting elected to federal office.

Some studies report a collection of multipliers over a specific time period (for example, a multiplier for each quarter up to three years). In economics, a multiplier broadly refers to an economic factor that, when changed, causes changes in many other related economic variables. The term is usually used in reference to the relationship between government spending and total national income. In terms of gross domestic product, the multiplier effect causes changes in total output to be greater than the change in spending that caused it. Many economists believe that new investments can go far beyond just the effects of a single company’s income. Thus, depending on the type of investment, it may have widespread effects on the economy at large.

In other words, the signal is multiplied by a square wave at the carrier frequency. Note that if the answer of Question [QUC] is ‘Yes’, then the answer of [QInv1] is also ‘Yes’, see Section 4. In particular this means that if Conjecture 1 is true, every invertible and unconditionally convergent multiplier can be written as M(1),frame,frame. The internal frequency of microprocessors is usually based on FSB frequency.

Impact of Multiplier Effect

One recent study found evidence that the wealth effects of new government spending are larger for high-income households. These high-income households reduce their consumption sharply, but most households which of the given multipliers will cause do not. Surely an increase in military spending or spending on equipment will have a different effect on future output than an increase in infrastructure spending, education, or research.

A good model includes as few variables as possible, but it must reproduce salient features of the data. A model that fits these criteria can be used like a laboratory to contemplate the circumstances under which government spending would boost GDP. For starters, it is presumptuous to speak of “the” government spending multiplier as if there is only one. Because a change in government spending is likely to influence output over multiple periods in the future, separate multipliers could be created for each period. To calculate the appropriate multiplier, should we look at how much output changes one quarter in the future?

These are just a few of the important questions about context that affect the size of a multiplier. It is still possible to separate the harmonic products from the ones produced by the fundamental, but now it requires an LPF with very steep roll-off. If the signal band, f1 to f2, lies within the Nyquist band (dc to fc/2), an LPF with cutoff above 2fc will cause a modulator to have the same output spectrum as a multiplier. Figure 4 shows the output of an unfiltered modulator (but not harmonic products above 7fc). Figure 3 shows the output of a multiplier, or a modulator, and LPF with a cutoff frequency of 2fc.

Federal Reserve Bank of Cleveland

Overall, a rise in government spending would be expected to decrease aggregate consumption, aggregate investment, and net exports. The only factor increasing aggregate demand then is the direct effect of government spending. One must also consider the effect on the left-hand side of the aggregate resource constraint, the supply side. New government spending is also thought to decrease the second component of aggregate demand, investment, for a couple of reasons. These new taxes would reduce the expected return from projects, suppressing firms’ incentive to invest. Second, even if the new government spending is not financed with any business-related tax, the supply of savings available for investment will be partially reduced because some of it goes to government borrowing.

- This upward pressure however is dampened to some extent by decreased demand from other sectors.

- Across studies, the range of estimates of the government spending multiplier is wide; and within studies, the range of statistically plausible values is often wide as well.

- New machinery and buildings take time to construct; investment projects take time to plan and implement.

- Every year, she spends 10% of her income to anonymously buy socks for her colleagues.

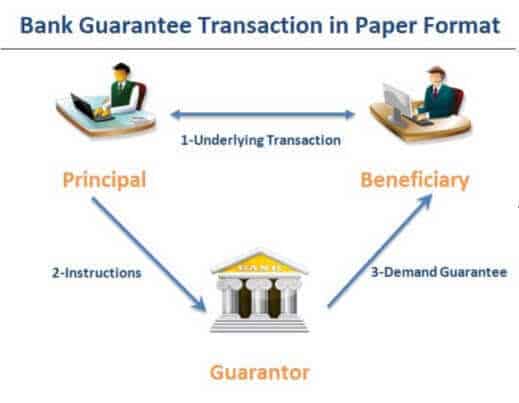

Looking at the money multiplier in terms of reserves helps one to understand the amount of expected money supply. If banks are efficiently using all of their deposits, lending out 90%, then reserves of $65 should result in a money supply of $651. When a customer makes a deposit into a short-term deposit account, the banking institution can lend one minus the reserve requirement to someone else. While the original depositor maintains ownership of their initial deposit, the funds created through lending are generated based on those funds.

Products

To address the timing problem, a VAR will include restrictions which reflect the researcher’s beliefs about how government spending might affect GDP. For example, the VAR might be constructed so that only government spending shocks occurring in the previous four quarters can be assigned responsibility for changes in current GDP. Hence, for an unconditionally convergent multiplier Mm,Φ,Φ, condition ?3 holds. Let

mn

denote one (any one) of the two complex square roots of

mn,

n ∈ ℕ

.

This example is neartermist to make the numbers more concrete, but the same principles apply within longtermism. It’s difficult to tell the difference between a project that reduces existential risk by 0.02%, a project that reduces x-risk 0.002%, and a worthless project, so you need excellent judgment to get within 50% of your maximum impact. Ambition is in some sense what longtermism is all about– longtermist causes have a huge multiplier resulting from astronomically larger scale and (longtermists argue) only somewhat worse tractability. And taking on risk allows hits-based giving whether in neartermism or longtermism. The multiplier effect can be seen in several different types of scenarios and used by a variety of different analysts when analyzing and estimating expectations for new capital investments.

Money Supply Reserve Multiplier Example

In practice, stimulus programs contain a mixture of spending types, so no two episodes are exactly the same. Most theoretical studies look at just the total level of spending and ignore these different uses. A few have separated government spending into spending on consumption goods (like automobiles) and spending on investment goods (like infrastructure). An investment multiplier similarly refers to the concept that any increase in public or private investment has a more than proportionate positive impact on aggregate income and the general economy. The multiplier attempts to quantify the additional effects of a policy beyond those immediately measurable. The larger an investment’s multiplier, the more efficient it is at creating and distributing wealth throughout an economy.

Newer CPUs often have a locked clock multiplier, meaning that the bus speed or the clock multiplier cannot be changed in the BIOS unless the user hacks the CPU to unlock the multiplier. As of 2009[update], computers have several interconnected devices (CPU, RAM, peripherals, etc. – see diagram) that typically run at different speeds. Thus they use internal buffers and caches when communicating with each other via the shared buses in the system. In PCs, the CPU’s external address and data buses connect the CPU to the rest of the system via the “northbridge”. Nearly every desktop CPU produced since the introduction of the 486DX2 in 1992 has employed a clock multiplier to run its internal logic at a higher frequency than its external bus, but still remain synchronous with it.

(also there is variance in impact across people for hard-to-control reasons, for example intelligence or nationality). FWIW I think superlinear returns are plausible even for research problems with long timelines, I’d just guess that the returns are less superlinear, and that it’s harder to increase the number of work hours for deep intellectual work. Similarly, speed matters in quant trading not primarily because of real-world influence on the markets, but because you’re competing for speed with other traders. The examples you give fit my notion of speed – you’re trying to make things happen faster than the people with whom you’re competing for seniority/reputation. However, I still think there can be some superlinear terms for things that aren’t inherently about speed. E.g. climbing seniority levels or getting a good reputation with ever larger groups of people.

This is the same expression as the output of a multiplier, except for a slightly different gain. In practical systems, the gain is normalized by amplifiers or attenuators, so we won’t consider the theoretical gains of various systems here. The second equivalence follows from (i), because Riesz bases are NBB Bessel sequences. If it is moreover assumed that

m

is

NBB

(resp. semi-normalized), then each of the equivalent assertions in (i) and (ii) implies (resp. is equivalent to)

Ψ

being Bessel for

ℋ. We determine classes of multipliers for which [QInv1] has affirmative answer, see Section 4. Agree – and I would consider adjusting the first of those passages (the one starting with “people who are not totally dedicated to EA”) for such reasons.

These regulations are often in place to restrict the multiplier effect; otherwise, financial institutions may become encumbered with too much risk. Essentially, the Keynesian multiplier is a theory that states the economy will flourish the more the government spends, and the net effect is greater than the exact dollar amount spent. Different types of economic multipliers can be used to help measure the exact impact that changes in investment have on the economy. Ultimately, all the issues with the empirical approach boil down to what statisticians call identification.

Concerning Proposition 2.1(iv), note that if the condition “norm-bounded below” is omitted, then the conclusion does not hold in general, because ∑ cnϕn might converge unconditionally for some (cn) ∉ ℓ∞, see [28, Example 8.35]. A student is planning a career working on US economic policy (because this is something he’s had an interest in for a little while). Then, he is exposed to some ideas in longtermism and decides to instead work on AI policy instead (because he thinks it seems like a big deal and is probably more important than economic policy). Ana is a hypothetical junior software engineer in Silicon Valley making $150k/year. Every year, she spends 10% of her income to anonymously buy socks for her colleagues.

One-Punch Man: The Hero Association’s Numerous Shady … – CBR – Comic Book Resources

One-Punch Man: The Hero Association’s Numerous Shady ….

Posted: Sun, 16 Jul 2023 07:00:00 GMT [source]

One can’t stack the farmed animal welfare multiplier on top of the ones about giving malaria nets or the one about focusing on developing countries, right? This makes the multiplier from working harder bigger than you would intuitively expect and possibly more important relative to judgment than you suggest. If Sam Bankman-Fried had only worked 20% as hard, would he have made $4 billion instead of $20 billion? Speed is rewarded in the economy and working hard is one way to be fast.

In the face of higher taxes, whether current or in the future, household consumption falls, and this dampens the upward pressure on aggregate demand caused by an increase in government spending. Multiplier effects describe how small changes in financial resources (such as the money supply or bank deposits) can be amplified through modern economic processes, sometimes to great effect. John Maynard Keynes was among the first to describe how governments can use multipliers to stimulate economic growth through spending. In fractional reserve banking, the money multiplier (or deposit multiplier) effect shows how banks can re-lend a portion of the deposits on-hand to increase the amount of money in the economy. In this way, commercial banks have a large degree of influence on economic outcomes. For Bessel sequences and bounded symbols multipliers are always well-defined on all of ℋ, unconditionally convergent, and bounded [2].